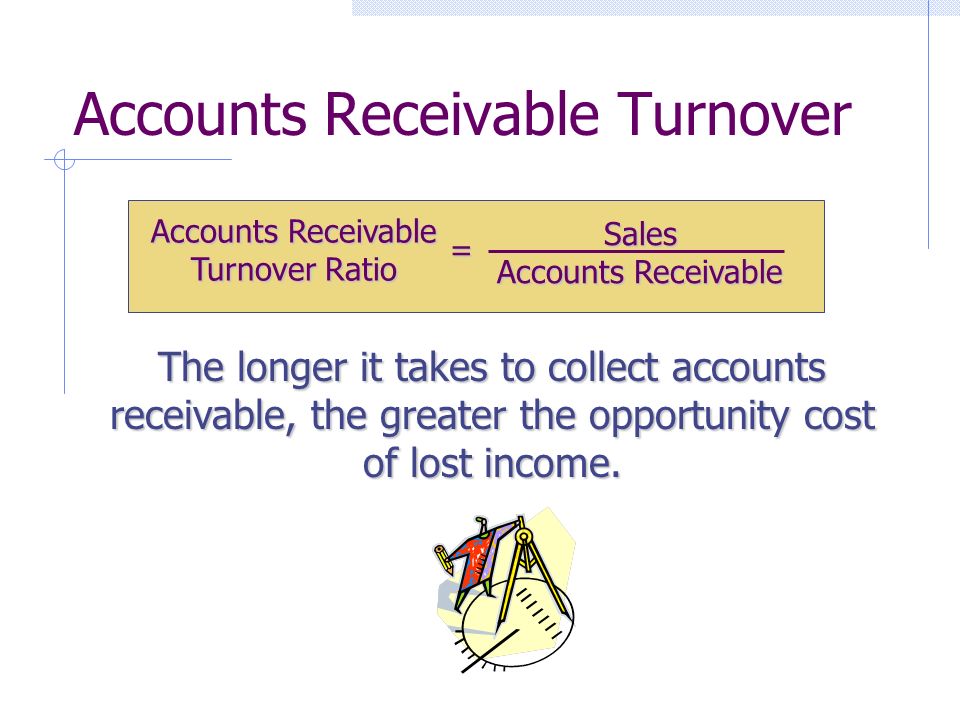

keeps its accounts receivable up to date. Earlier we mentioned that the accounts receivable. The formula for calculating accounts receivable is: AR Turnover Ratio Net Credit Sales ÷ Average Accounts Receivable.

#AR TURNOVER RATIO DEFINITION HOW TO#

How To Calculate The Accounts Receivable Turnover Ratio. ($55,000 / $400,000) x 365 days = 50 days This makes the ratio intuitively easy to understand when comparing multiple companies across the same industry. has annual sales of $400,000 and accounts receivable of $55,000, its average collection period would be calculated as follows:

More about the average collection periodĪccounts receivable appear on a company’s balance sheet while sales appear on the income statement. The formula for calculating average collection period is:Īverage collection period = (accounts receivable / sales) x number of days in a yearĪ shorter average collection period (60 days or less) is generally preferable and means a business has higher liquidity.Īverage collection period is also used to calculate another liquidity measure, the receivables turnover ratio.

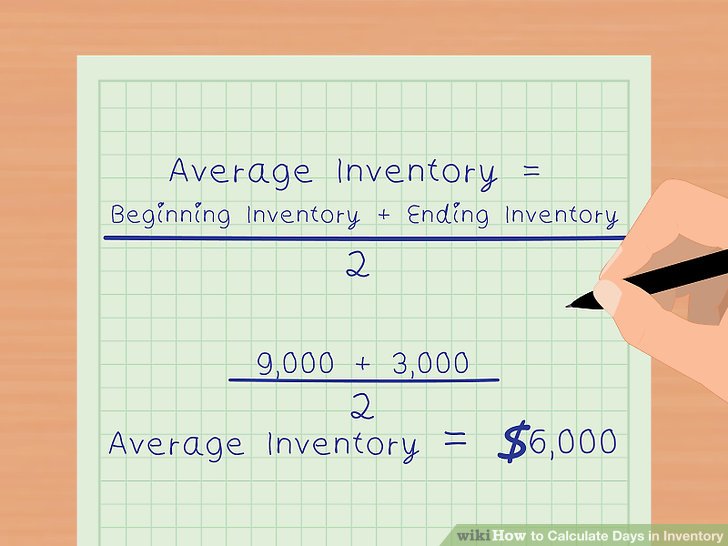

It is one of six main calculations used to determine short-term liquidity, that is, the ability of a company to pay its bills (current liabilities) as they come due. A high receivables turnover ratio can indicate that a companys collection of accounts receivable is efficient and that it has a high proportion of quality. The average collection period is the average number of days it takes a business to collect and convert its accounts receivable into cash. A higher AR turnover is generally desirable. The inventory turnover ratio formula is equal to the cost of goods sold divided by total or average inventory to show how many times inventory is turned or sold during a period. The accounts receivable turnover ratio helps evaluate how effectively a business can recover its payments from its outstanding invoices. Used to measure how effectively a firm is managing its accounts. It’s a ratio calculated by dividing net sales by the average AR balance during the period. The accounts receivable turnover ratio (or receivables turnover ratio) is an important financial ratio that indicates a companys ability to collect its. The inventory turnover ratio, also known as the stock turnover ratio, is an efficiency ratio that measures how efficiently inventory is managed. Total operating revenues divided by average receivables.

Growth & Transition Capital financing solutions It reflects the number of times the average AR balance is converted to cash during a period, typically a year. Kauffman Fellows Program Partial Scholarship Venture Capital Catalyst Initiative (VCCI) Industrial, Clean and Energy Technology (ICE) Venture Fund

0 kommentar(er)

0 kommentar(er)